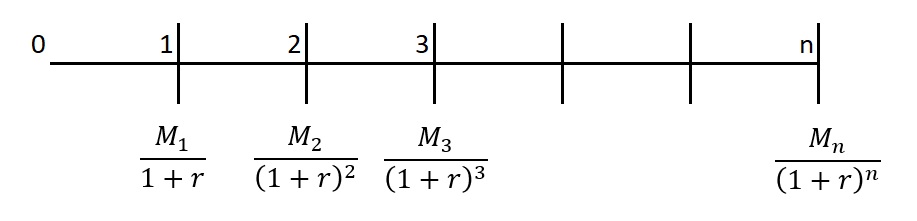

Present Value (PV) of an annuity

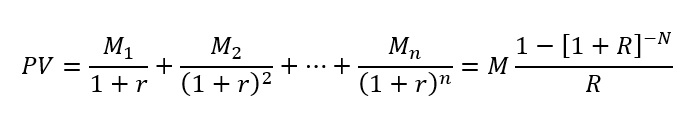

The Present Value (PV) of an annuity is a financial concept that represents how much money would be required now to produce a series of payments in the future, against assuming a constant interest rate.

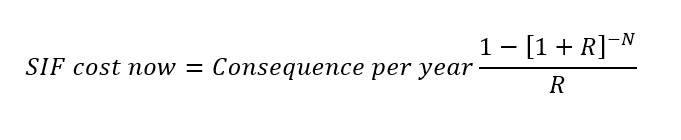

When applying the Present Value of an annuity to justify the maximum of SIF before investment. We can apply the consequence per year (Consequence x Initial Event Likelihood) to a consequence per year and the mathematical formula has been changed to the following.

Example-1

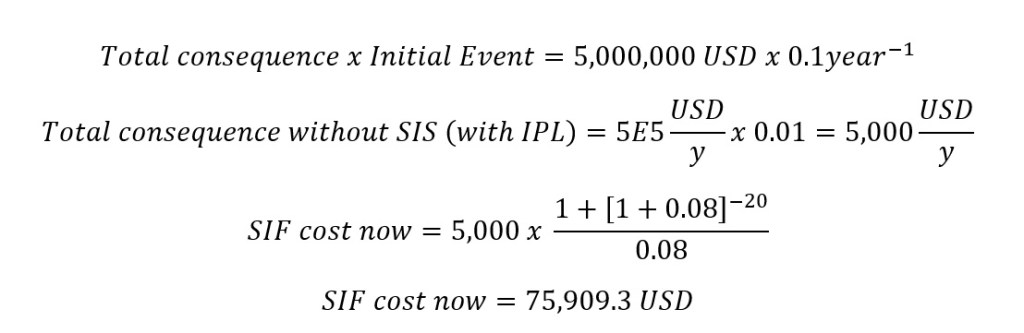

The result of the malfunction of the pressure controller is a leakage from ethylene evaporation overpressure. This will lead to a vapor cloud explosion (VCE) and that will cause asset catastrophic damages 5,000,000$. Currently, the existing plant has the PSV to prevent the overpressure. An SIS is being considered to reduce the risk which the expected life is 20 years and the interest rate is 8%. What is the highest amount of money that can be cost-effective?

Benefit-To-Cost (BTC) Ratio

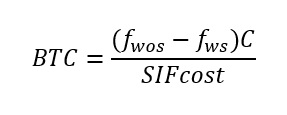

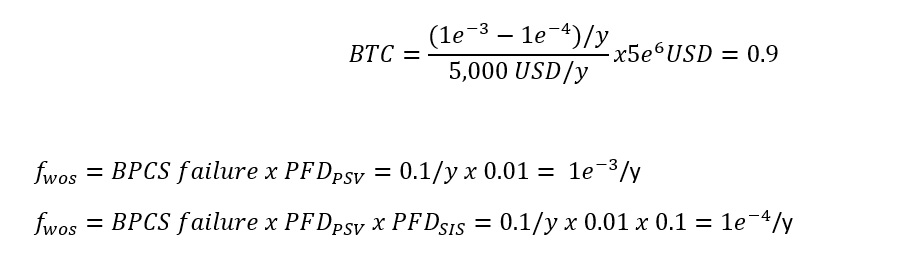

The benefit-to-cost ratio or (BTC) is a financial metric used to evaluate the profitability and feasibility of an investment. For the specific application to the SIS context, the BTC has calculated the effectiveness of the SIS compared with the total SIF cost. The formula for Benefit-To-Cost (BTC) ratio is as follows:

If BTC > 1, it indicates that the benefits of SIS outweigh the investment costs, suggesting that the investment is potentially worthwhile.

If BTC <1, it suggests that the SIF costs exceed the benefits, which may raise concerns about the economic viability.

Example-2

From example-1, the client is considering installing an SIF-SIL1 which will have an annualized cost of 5,000 USD. What is the benefit-to-cost ratio for an installation of the SIF?

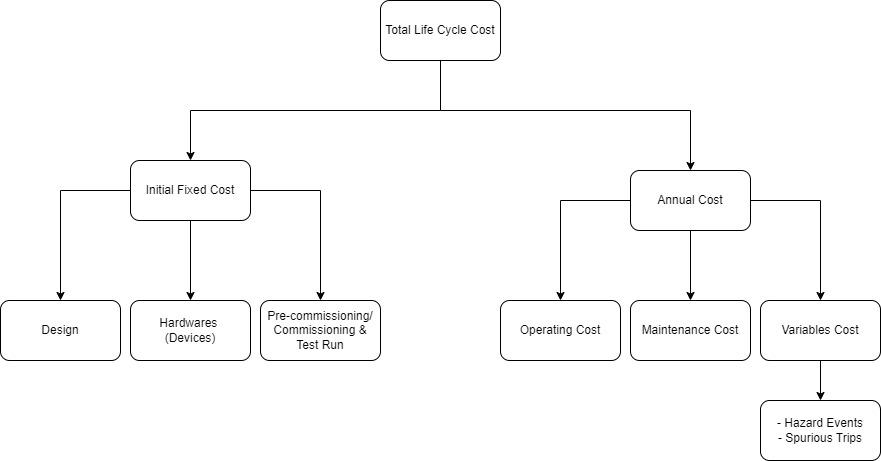

Life Cycle Cost (LCC)

The life Cycle Cost or LCC presents the total cost of an installation and operating cost or annual cost. The below figure presents typical components of the life cycle cost for a safety instrumented system.

Total Life Cycle Cost (LCC) consists of two types which are fixed cost (USD) and time/event base (USD/time).